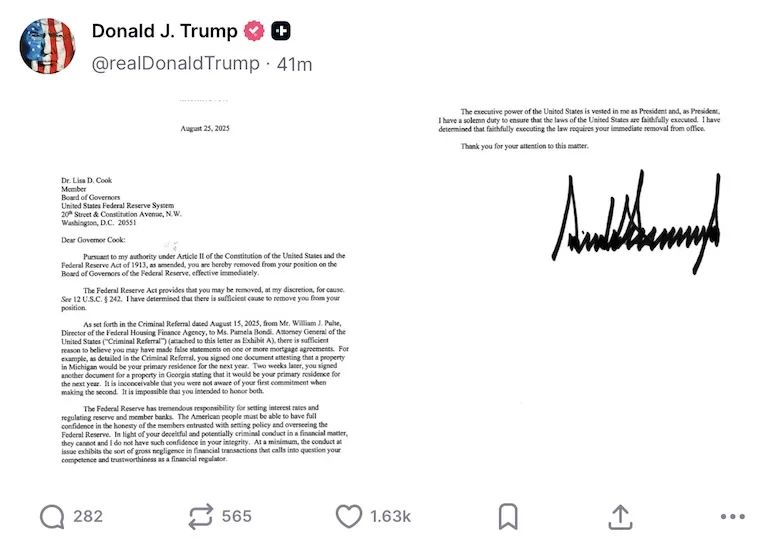

🔥 Attention crypto community: Trump's recent actions include firing Federal Reserve Board member Lisa Cook 💥 and sending a letter to Powell requesting an interest rate cut 📉.

Market reaction:

✅ Slight fluctuations in the dollar 💹

✅ Gold prices rising 🪙

✅ Some rebound in crypto assets 🚀

👉 This could be a potential signal for liquidity easing, but we need to observe actual policy changes 👀

▍ Logical analysis: Political pressure = crypto opportunity?

1️⃣ Rising expectations for interest rate cuts 📊: Trump urges immediate rate cuts ❗️ June PPI remains unchanged (0% growth), economic data supports a 87-91% probability of a rate cut in September (CME FedWatch) 🔥. If realized ⏳, it could recreate the low interest rate environment of 2020 🌊, pushing BTC to rebound from its lows 📈 (but the extent of the increase is uncertain ⚠️)

3️⃣ Potential risks to dollar trust 💣: If Fed Chair Powell is influenced by politics 🤝, Deutsche Bank warns ⚠️ that the dollar could drop by 3-4% 📉. Investors may turn to ⤵️:

⛑️ Gold as a safe haven or

🪙 Upgraded censorship-resistant properties of Bitcoin (needs market validation 🧪)

2️⃣ DeFi and RWA may benefit 💎:

🌪️ If central bank independence weakens → funds may flow into decentralized finance (DeFi) havens

🏦 RWA sector (Ondo, Mantra, etc.) may attract whale attention 🐋 (but need to keep an eye on regulations 👮♂️)

▍ Market observation points: Stay rational, don’t chase FOMO ❗

⏱️ Short-term: ETH/BTC ratio fluctuations ⚖️ + Layer2 (ARB, OP) gas fees stable ⛽️ = growth signal 📶

📅 Mid-term: BTC ETF inflows 💸 + stablecoin market cap (USDT/USDC) 📊 = core indicators 🧭

🔮 Long-term:

🧩 Modular chains (TIA, DYM) absorbing liquidity overflow 🌊

🤖 AI + crypto (RNDR, FET) taking over the narrative 🏃♂️

💡 Technical guide for the guys: Political entropy increases → dollar credit declines → crypto entropy decreases! On-chain is the future 🌐

Show original

18.59K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.