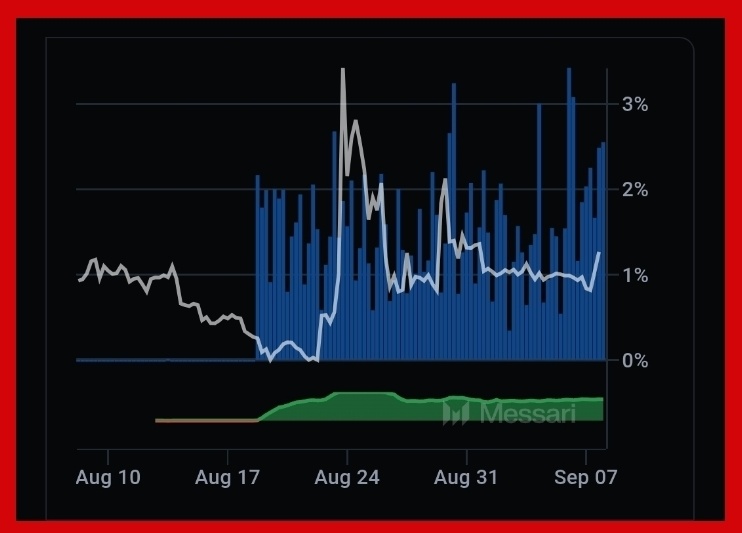

Token buybacks from the open market is one of the best ways to keep it alive and sustainable in the long term. Revenue --> Buybacks This is how a lot of tokens get back above ICO price after the first dump. Recently, @Covalent_HQ announced that they bought back 900,000 $CXT. They've monetized the usage and used that cash flow to erase $CXT from existence. That’s 900K tokens permanently removed from circulation, funded by real revenue. Covalent routes 95% of paid API fees into daily token buybacks—not monthly, not quarterly, but daily. This is happening on autopilot, and it’s only getting stronger. Over the last year, they’ve burned nearly 0.77% of total supply while locking up another 33% in staking. That means more than a third of all CXT is already off the market. And what’s driving this machine? Real API usage across 200+ chains. Covalent is indexing the full chain state, powering developers, dApps, AI agents, and DePIN infra with high-resolution data. With modules like...

Show original

14.32K

163

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.