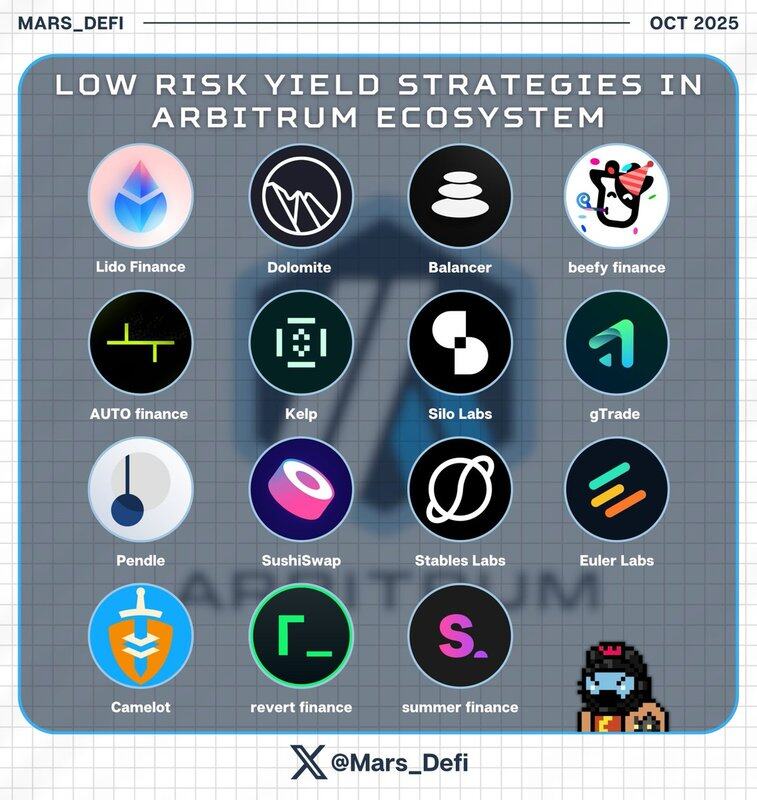

Arbitrum isn’t slowing down.

More protocols, deeper liquidity, better incentives, and new ways to earn without rotating into high-risk plays.

The ecosystem keeps delivering real, measurable yield, so here’s part 2 of yield strategies delivering steady yield on @arbitrum .

I dropped the first part of the Arbitrum yield series a while back.

Check it out for more yield options.

@USDai_Official x @0xfluid

• Visit

• Mint USDai and stake to receive sUSDai

• Visit

• Switch network to Arbitrum

• Select the sUSDai/USDC market and deposit sUSDai and USDC in variable or fixed proportions (12.71% APY + 10x Allo points).

@ether_fi x @RelayProtocol x @GammaSwapLabs

• Visit

• Stake $ETH for weETH

• Visit

• Bridge weETH from Ethereum to Arbitrum

• Visit

• Switch to Arbitrum and select the weETH/USDC pool

• Deposit both assets into the pool or zap in a single asset to receive GSLP tokens (14.93% APR + 2x EtherFi points)

• Stake LP tokens into the weETH/USDC GSLP Farm (7.36% APR).

@CoWSwap x @SkyEcosystem x @Morpho

• Visit

• Swap USDC on Arbitrum into USDS

• Visit

• Stake USDS to receive sUSDS (4.5% APR)

• Visit

• Select the sUSDS/USDC market on Arbitrum

• Deposit sUSDS to borrow USDC (2.19% APR) and loop (~14% APY after 5 loops).

@KelpDAO x @DeriveXYZ

• Visit

• Stake $ETH for rsETH (3.3% APY)

• Bridge from Ethereum to Arbitrum

• Visit

• Select the rsETH Harvest Vault and switch network to Arbitrum

• Deposit rsETH to receive rsETHC (29.86% APY).

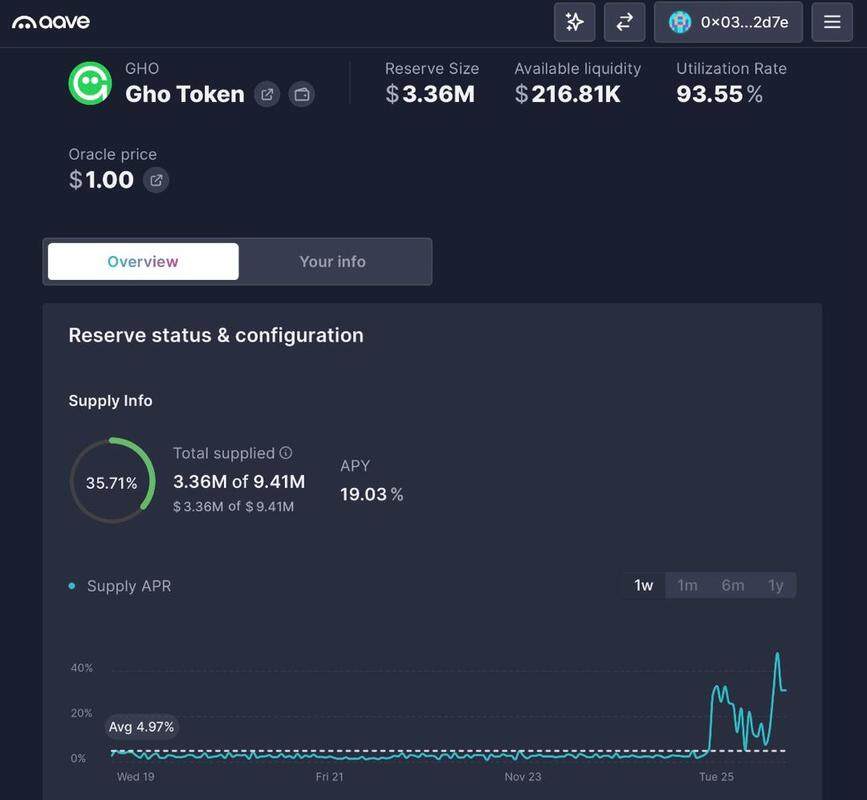

@aave

• Visit

• Supply $ETH on Ethereum (1.19% APY)

• Borrow GHO (5.13% APY)

• Bridge GHO to Arbitrum using Aave’s GHO bridge

• Switch network to Arbitrum

• Supply GHO (19.03% APY).

@squidrouter x @PancakeSwap

• Visit

• Swap some USDC into Axelar USDC

• Visit

• Switch network to Arbitrum

• Navigate to the “Farm/Liquidity” section of the Earn tab

• Provide liquidity to the USDC/axlUSDC pool (6.88% APR).

@Rocket_Pool x @HopProtocol x @RDNTCapital

• Visit

• Stake $ETH for rETH

• Visit

• Bridge rETH from Ethereum to Arbitrum

• Visit

• Select the rETH market

• Adjust leverage and deposit rETH (31.33% APR at max leverage).

@USDai_Official x @Uniswap

• Visit

• Mint USDai using USDC

• Visit

• Check out the pools and select the USDai/USDC pool

• Select fee tier and set price range

• Provide liquidity to the USDai/USDC pool (18.29% APR).

Tagging top Arbitrum voices

@xerocooleth

@Defi_Warhol

@kenodnb

@ripchillpill

@NDIDI_GRAM

@OxTochi

@CryptoUsopp

@0xCheeezzyyyy

@sgoldfed

@Jampzey

@marcuslayerx

@Solofunk

@bjnpck

@francescoweb3

@uttam_singhk

@Deebs_DeFi

@pgreyy

@blackbeardXBT

@icobeast

@crypto_linn

@zaimiri

@chilla_ct

@rektonomist_

@CryptoBusy

@MeshClans

@phtevenstrong

@MookieNFT

@Kaffchad

@StarPlatinum_

@0xtyler

6.85 K

76

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.