The Best Crypto Credit Cards with Rewards in 2025

The world of cryptocurrency is no longer just about trading and investing; it's now seamlessly integrating with our daily financial lives. One of the most exciting developments in this space is the rise of the crypto credit card. These innovative cards bridge the gap between traditional finance and the digital asset economy, allowing you to earn cryptocurrency rewards on your everyday spending. This guide will walk you through the best crypto credit cards with rewards available in the US for 2025, helping you choose the right card to maximize your earnings.

How Do Crypto Credit Cards Work?

At its core, a crypto credit card functions just like a traditional credit card. You can use it to make purchases anywhere major credit cards are accepted. The key difference lies in the rewards. Instead of earning cash back, points, or airline miles, you earn cryptocurrency. The rewards you earn are typically deposited into your account on the crypto platform that issues the card.

Key Features to Look for in a Crypto Credit Card

When choosing a crypto credit card, there are several factors to consider to ensure you're getting the most value.

- High Reward Rates: The most important feature is the percentage of your spending that you earn back in crypto. Look for cards with competitive, uncapped reward rates.

- Variety of Reward Cryptocurrencies: Some cards only offer rewards in a specific cryptocurrency, while others give you the flexibility to choose from a range of options.

- No Annual Fee: Many of the best crypto credit cards come with no annual fee, making them a cost-effective way to earn crypto.

- Sign-Up Bonuses: Some cards offer a welcome bonus, giving you a lump sum of crypto after you meet a certain spending threshold.

- Additional Perks: Look for other benefits like no foreign transaction fees, special partner discounts, or higher reward rates on certain spending categories.

Top 5 Crypto Credit Cards with Rewards for 2025

Here are our top picks for the best crypto credit cards with rewards in the US.

Gemini Credit Card: The Flexible Rewards Powerhouse The Gemini Credit Card is a top contender for its high reward rates and flexibility. It offers up to 3% back on dining, 2% on groceries, and 1% on everything else. What makes it stand out is the ability to earn rewards in a wide variety of cryptocurrencies, including Bitcoin, Ethereum, and many others, which are deposited into your Gemini account in real-time.

BlockFi Rewards Visa® Signature Card: The Bitcoin Maximizer For those who are bullish on Bitcoin, the BlockFi Rewards Card is an excellent choice. It offers a straightforward, flat 1.5% back in Bitcoin on every purchase, with no annual fee. Plus, it often comes with an attractive sign-up bonus and other perks like a higher rewards rate for high-volume spenders.

Crypto.com Visa® Card: The Tiered Benefits King The Crypto.com Visa is technically a prepaid debit card, but it functions like a credit card for purchases and offers some of the most impressive rewards in the space. The rewards and benefits are tiered based on the amount of CRO (Crypto.com's native token) you stake. Higher tiers can unlock perks like 100% back on Spotify and Netflix subscriptions, airport lounge access, and up to 8% back on spending.

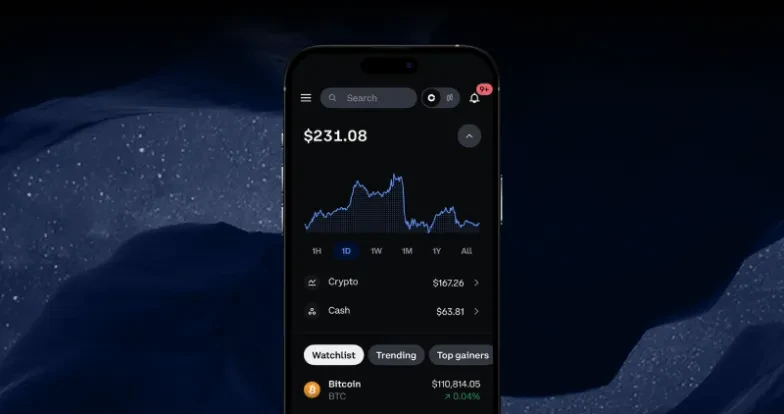

Coinbase Card: The User-Friendly Choice The Coinbase Card is another prepaid debit card that allows you to spend your existing crypto balance and earn rewards. It offers a rotating selection of crypto rewards, allowing you to earn up to 4% back in different cryptocurrencies. Its integration with the popular Coinbase app makes it a very user-friendly option for beginners.

Uphold Card: The Multi-Asset Spender The Uphold Card is a debit card that lets you spend from any asset you hold on the Uphold platform, including cryptocurrencies, precious metals, and stocks. It offers a simple 2% back in crypto on every purchase, making it a great choice for those who want to diversify their rewards.

Understanding the Risks and Considerations

While crypto credit cards offer an exciting way to earn digital assets, there are a few things to keep in mind.

- Volatility of Rewards: The value of your crypto rewards can be highly volatile. The 2% you earn in Bitcoin today might be worth more or less tomorrow. This is a key difference from the stable value of cash back rewards.

- Tax Implications: In the US, earning crypto rewards is generally considered income and is subject to income tax. When you sell or exchange the crypto you've earned, it's also subject to capital gains tax. It's important to keep good records and consult with a tax professional.

- Credit Score Requirements: Just like traditional credit cards, you'll need a good credit score to qualify for the best crypto credit cards.

How to Maximize Your Crypto Rewards

Here are a few tips to get the most out of your crypto credit card.

- Choose the Right Card for Your Spending Habits: If you spend a lot on dining, a card like the Gemini Credit Card with bonus rewards in that category might be the best choice. If you prefer a simple, flat rate, the BlockFi card is a great option.

- Pay Your Balance in Full: Crypto credit cards are still credit cards, which means they can charge high interest rates if you carry a balance. To make the most of your rewards, always pay your bill in full and on time.

- Take Advantage of Sign-Up Bonuses: If a card offers a sign-up bonus, make sure you can meet the spending requirements to claim it. This can be a great way to kickstart your crypto holdings.

Frequently Asked Questions (FAQ)

Q1: Do I need to own crypto to get a crypto credit card? No, you don't need to own crypto to apply for a crypto credit card. The rewards you earn will be your entry point into the world of digital assets.

Q2: Are crypto credit card rewards taxable? Yes, in the US, crypto rewards are typically subject to income tax. You should consult with a tax professional for guidance on your specific situation.

Q3: Can I choose which crypto I earn as a reward? It depends on the card. Some cards, like the Gemini Credit Card, offer a wide selection of cryptocurrencies to choose from, while others, like the BlockFi card, are focused on a single crypto like Bitcoin.

Q4: Is it safe to use a crypto credit card? Yes, crypto credit cards are issued by major payment networks like Visa and Mastercard and come with the same security features as traditional credit cards, such as fraud protection and EMV chips.

Q5: Can a crypto credit card hurt my credit score? A crypto credit card is just like any other credit card when it comes to your credit score. Applying for the card will result in a hard inquiry, and your payment history and credit utilization will be reported to the credit bureaus.

Conclusion

Crypto credit cards with rewards offer a powerful and easy way to build your digital asset portfolio through your everyday spending. With a variety of great options available in the US, you can choose a card that aligns with your financial goals and spending habits. By understanding the features, benefits, and risks, you can make an informed decision and start earning crypto on every purchase you make.

Disclaimer: This article is for informational purposes only and does not constitute financial or tax advice. The world of cryptocurrency and credit cards involves risks. Be sure to do your own research and consult with qualified professionals before making any financial decisions.